How Long Can You Finance a Boat?

- Patrick Farres

- Aug 19, 2025

- 5 min read

The Short Answer: Most boat loan terms range from 5 to 20 years, with 10-20 years being the most common loan length. Your ideal boat loan term depends on your budget, type of boat, and how long you plan to keep the vessel.

Boat ownership opens up endless possibilities for offshore adventures. Whether you dream of pursuing trophy fish in open waters, discovering remote coastal hideaways, or experiencing the thrill of deep-sea fishing expeditions, a boat provides the freedom to venture far beyond the shoreline. While the purchase price of a serious offshore vessel might seem daunting, boat financing makes this seafaring lifestyle more accessible to many anglers.

Today's boat loan options offer multiple paths to ownership, with loans available through financial institutions, credit unions, and marine-specific lenders. Understanding your loan terms - and how they affect your monthly payments and total costs - helps you make smart choices about financing your boat purchase. This guide breaks down everything you need to know about boat loan lengths, comparing different terms and helping you choose the right financing timeline for your situation.

Common Boat Loan Terms and Financing Options Explained

Most lenders offer boat loan terms ranging from 5 to 20 years, with specific financing options varying based on the boat's purchase price, age, and your financial situation.

Standard Financing Timeframes

The loan length affects both monthly payments and total interest costs:

5-7 year loans work well for smaller boats under $25,000

7-12 year loans are common for boats between $25,000 - $50,000

10-20-year boat loans typically apply to boats over $50,000

Loan Terms by Boat Type

New Boats:

Qualify for longer loan terms (up to 20 years)

Often have lower interest rates

More flexible down payment options

Used Boats:

Usually, max out at 15-year terms

Slightly higher interest rates

May require larger down payments

Age limits apply (usually 15-20 years old max)

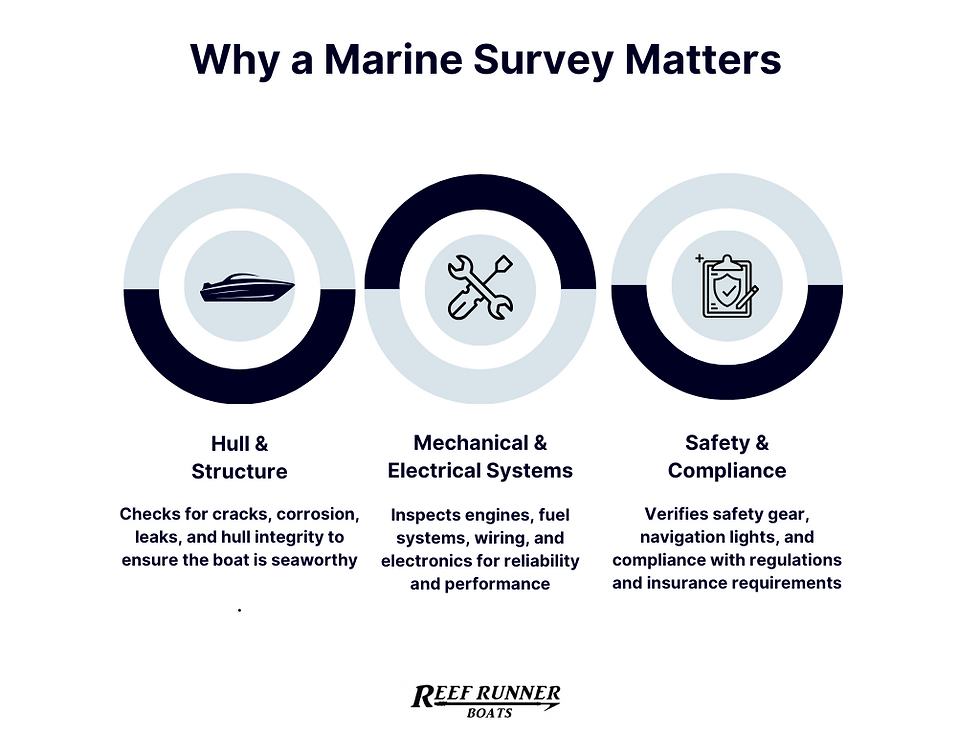

What is a Marine Survey?

Before financing a boat, especially a pre-owned boat, many lenders and insurance companies require a marine survey. This detailed inspection, performed by a certified marine surveyor, evaluates the boat’s structural condition, systems, and seaworthiness. Even for new or custom-built boats, a marine survey can uncover overlooked issues and confirm build quality. It also helps establish the vessel’s fair market value, which may affect loan approval and insurance coverage.

Down Payment Requirements

Most boat financing lenders expect:

10-20% down for newer boats

15-25% down for used boats

Larger boats often require higher percentages

Interest Rate Factors

Your boat loan interest rate depends on several factors:

Term Length Impact:

Shorter loan terms (5-7 years): 4-6% rates

Medium terms (8-12 years): 5-7% rates

Longer loan terms (13-20 years): 6-8% rates

Excellent credit score (700+): Best available rates

Good credit (640-699): Mid-range rates

Below 640: May need specialized lenders

Fixed rates offer predictable monthly payments

Variable rates start lower but can increase

Most boat buyers choose fixed rates for stability

Monthly Payments vs. Total Boat Loan Cost

The boat loan term you choose has a major impact on both your monthly payment and the total amount you'll pay. Let's break down how different financing periods affect your boat purchase costs to help you find the right balance.

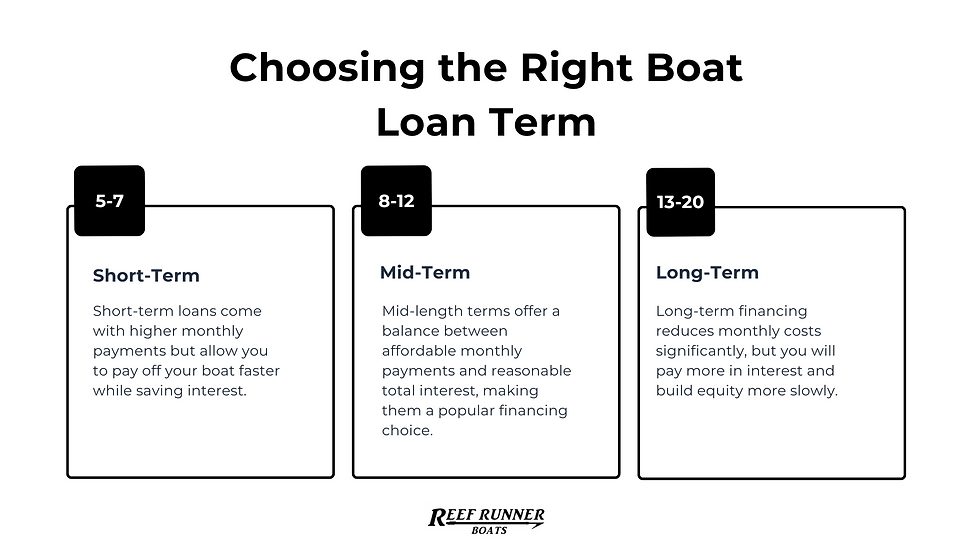

Short-Term Financing (5-7 Years)

A shorter loan term means you'll pay off your boat loan faster, but with higher monthly payments. On a $50,000 loan amount at a 6.5% interest rate, your monthly payment might be around $875 for a 5-year term. While these payments are steeper, you'll build equity quickly and pay less in total interest, typically saving $10,000 to $15,000 compared to longer loan terms.

Mid-Term Financing (8-12 Years)

Most boat financing customers choose this middle-ground option. Using the same $50,000 loan example, a 10-year term reduces monthly payments to about $570. This timeframe offers a good mix of reasonable monthly costs and manageable total interest, making it practical for many budgets.

Long-Term Financing (13-20 Years)

Stretching your boat loan to a 15 or 20-year loan can drop monthly payments significantly, as low as $375 for that $50,000 loan. However, you'll pay substantially more in interest over time, potentially doubling your total loan cost. Plus, boats often depreciate faster than you build equity with longer terms.

Using Payment Tools

Online boat loan calculators help you compare scenarios:

Input different loan amounts and terms

Compare monthly payments across timeframes

Calculate total interest costs

Factor in your down payment

Remember to add about 10-15% to your monthly budget for boat insurance, maintenance, and storage costs beyond your loan payment.

How You Should Finance Your Boat

When planning your boat loan, thoughtful consideration of both your financial situation and boat-specific details will lead to a sound, informed decision.

Your Financial Picture

Your monthly payment sets the foundation for boat financing. A practical approach is to limit your boat loan payment to 10-15% of your disposable income. Remember that this payment needs to fit comfortably alongside your existing debt-to-income ratio without creating financial strain.

Your planned boat usage directly impacts the loan term choice. Weekend warriors might opt for a shorter term with higher monthly payments, while frequent users often choose longer loan terms to match extended boat ownership plans. Consider how the boat fits your lifestyle over the next 5-10 years.

Boat-Related Factors

The purchase price and type of boat influence available loan terms. New boats typically qualify for longer financing periods and better interest rates than used boats. Larger boats often depreciate more slowly but come with higher operating costs.

Annual maintenance typically runs 5-10% of the boat's value, while boat insurance can range from $300 to $1,000 yearly. Storage costs vary significantly from $50 monthly for trailer storage to $300+ for marina slips. Factor these ongoing expenses into your loan amount calculations.

Preparing for Financing

Your credit history significantly affects loan terms. Higher credit scores above 700 usually secure competitive rates. Most lenders expect a down payment of 10-20%, though some financial institutions may require more for used boats.

Boats Built for You. Financing Designed Around You.

Financing a boat is a big decision, but it doesn’t have to feel overwhelming. Whether you're buying your first fishing boat or upgrading to a serious offshore vessel, understanding your loan options helps you make a purchase that aligns with both your budget and your boating goals.

Run the numbers with a boat loan calculator and think long-term about how you’ll use and care for your boat. Choosing the right loan term means balancing affordability with total cost, so you can spend more time on the water and less time worrying about finances.

With the right plan, your dream of boat ownership can become a reality. All that’s left to do is start the journey.

Now that you understand the ins and outs of boat loan terms, it’s time to pair that financial knowledge with a boat that’s worth the investment. At Reef Runner Boats, we believe your financing plan should support a vessel that fits your needs and your lifestyle. Whether you choose our 23-foot, 28-foot, or 34-foot center console model, each boat is crafted with premium materials, thoughtful design, and tailored features that make every outing better. Let our team help you bring your vision to life with a boat built just for you. Contact Reef Runner today to start your journey.

Comments